By: David Macchia

Advisor Perspectives | March 21, 2022

Advisor Perspectives | March 21, 2022

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

As the number of Boomer husbands who pass away increases dramatically, their spouses will take control of wealth assets on a scale never seen. By the end of the decade, women will control an estimated $30 trillion, a reality that will transform financial services.

No investment professional, organization or channel owns a call option on success in retirement-income distribution. RIAs, especially, are misaligned for success. With a willingness to alter their business strategy, just a bit, RIAs can position themselves for robust achievement. However, RIAs must align their communications, planning methodologies, and product set with the needs of retirees, especially women, whose chief priority is reliability of income more than return on investment.

In my Advisor Perspectives article, The Trial of Ken Fisher for Crimes Against Annuities, I charged the well-known public figure, Ken Fisher, with three crimes against annuities:

- Misleading the public in a manner that causes incomplete or inaccurate understanding of annuities;

- Issuing a blanket condemnation that misrepresents the features and benefits of many annuities; and

- Depriving your clients the continuing income they will need to meet their essential expenses in retirement.

I found Fisher to be innocent of the three charges. Why? This is how I explained my decision:

It is ironic that the annuity industry may well owe Ken Fisher a big “thank you.” His high-profile criticisms were so widely broadcast and over the top, that they inflicted damage to such an extent that Fisher has helped foster a genuine reinvention of annuities.

Numerous benefits radiate to other annuity industry constituencies, including a first-ever consumer-driven demand for annuity products, especially those that provide lifetime guaranteed income.

Consider my vision for how differently the financial planning profession will look in just a few short years.

The year 2025 is not that far off. By then, however, I’m betting that many RIA firms will alter their business strategy. It will be driven by two factors: an awareness of the vast amounts of money in motion associated with retirement-income distribution; and the perceived opportunity to seize upon what will become, for them, a novel form of competitive advantage vis à vis other RIA firms. How might this show itself? Let’s imagine how one RIA’s journey plays out over the next three years and seven months (October 2025).

Imagine you are Ron, a registered investment advisor

Your name is Ron. You are 63 years of age and have been an investment professional for 34 years. Along with your 57-year-old business partner, Michael, you oversee a fee-based practice that manages $195 million.

Over a career that has spanned 36 years, you have experienced a great deal of change. When you entered the industry, your professional identity was that of a stockbroker. Some years later, it underwent a transformation as you came to be viewed as a “money manager.” Then still later, 14 years ago, your identity arrived at its final outpost, financial planner.

In 2022, for reasons that were both defensive and opportunistic, you decided to shift your professional emphasis. Today, you are fully engaged in the specialty of retirement-income planning. You enjoy it – so much so that over the past two years “income” has become your principal focus. You confidently trumpet your income planning skills. Your 2022 decision to focus your efforts on income planning was a wise one. In terms of attracting new assets, your shift in strategy has paid off handsomely.

Your embrace of annuities

For most of your career, you aggressively criticized annuities. When clients asked about them, you recommended against annuities, citing reasons such as:

- Too expensive

- No liquidity

- Complicated contracts

- High fees

- Your money is trapped

- I don’t accept commissions

- Salesmen sell annuities

Every time you saw Ken Fisher on television asserting, “I’d rather die and go to hell than sell an annuity,” your perspective was reinforced.

Then, something significant unfolded.

Now, you and I agree that Fisher was wrong about annuities.

Every time you meet with a prospective retiree client, it reminds you that the old complaints, criticisms, smears, and insults hurled at annuities have been rendered moot.

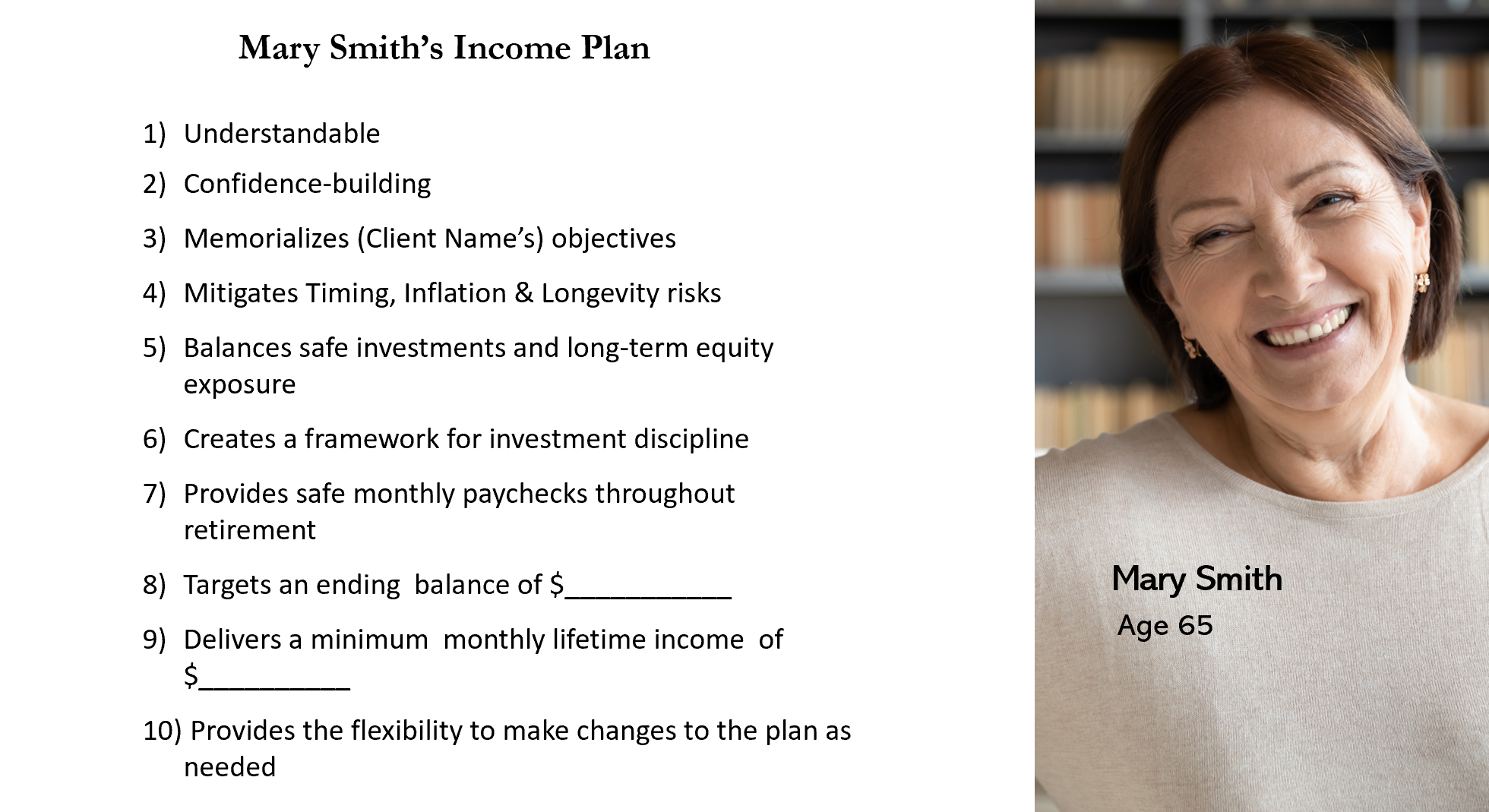

To illustrate the benefits your clients receive from the income plans you design, you show each new prospect your “Mary Smith Slide,” a PowerPoint slide which details the 10 strategic objectives of your typical retirement-income investing strategy. You tell the prospect that a high-level, yet fruitful exercise would be for you to prepare a similar slide listing objectives which ultimately may become part of the prospect’s personal, software-generated plan for creating lifetime inflation-adjusted income.

To date, not a single prospect has refused your generous offer. Quickly advancing them through your planning process is easy with this simple overture. After some discussion, you prepare and review this single PowerPoint slide, and the transition from prospect to client is made effortless.

When designing retirees’ income strategies, a wide variety of annuity contracts are available. You like certain annuities because they make for timely alternatives to bonds. Others, you’ve found, have utility in limiting downside risk while simultaneously providing upside growth potential. Your most frequent use of annuities, however, are those that provide lifetime guaranteed income. Depending upon the client’s profile, you may choose to begin income immediately or defer the payout for a period of years.

It was annuities that changed to accommodate you.

Including annuities in retiree portfolios strikingly mitigated your clients’ risk. You take comfort in knowing that annuities are safeguarding your clients against the income-destroying potential of both timing (sequence-of-returns) and longevity risk. Managing those risks for clients, who have so much at stake in seeing their retirement incomes sustained, is a responsibility you take seriously.

For a time, you did feel a measure of regret for neglecting clients’ income risk management needs. Luckily, the long bull market limited damage. Fortunately, you have since used annuities to repair exposures that would have caused grave problems given subsequent higher interest rates, persistent high inflation, and sub-par performance of capital markets. The simple mention to clients of, “a whole new world of annuities” made their implementation easy.

You lost clients

What led you to this point of income planning enlightenment?

Between February 2022 and August 2022, you lost six clients to advisors whose specialty is income-distribution planning. Upset by those losses, in every case you sought out the other advisor’s website. This exercise made a significant impact. In all six you reviewed, the other advisors’ websites were communicating a strikingly different value proposition than your firm’s site.

A radically altered website

You moved swiftly to redesign the website content so that its messaging aligns with the concerns of your target prospects. The enhanced site went live on October 1, 2022. A significant share of its content now addresses the retirement-income planning needs of Boomers. The revamped website includes words not mentioned in the old site: longevity risk, a framework for investment discipline when you are retired, safe monthly paychecks, inflation-adjusted retirement income, the impact of unlucky timing of retirement, and lifetime guaranteed income.

You are keenly aware that women are gaining control of wealth that will total as much as $30 trillion by the end of the decade. You’ve read research that states that, among married couples, the female spouse has typically never enjoyed sole discretion over investment-management decisions. Further, you’ve learned that, in the majority of instances following her husband’s passing, the first consequential investment management decision she makes is to fire the incumbent male advisor.

With all of this in mind, and confident in your ability to win your fair share of the trillions in retirement assets, you developed a discrete section of the website devoted to addressing the firm’s experience in helping women plan for retirement income. The website now includes phrases such as, “to many women, security is more important than prosperity,” “women often expect to encounter gender stereotypes when working with wealth managers,” “women have tended to invest more conservatively,” “women seek an authentic relationship,” and “women want to be listened to.”

Professionally, you have undergone a metamorphosis that, among other things, has taken you from annuity critic to zealot. Your willingness to be open-minded about all the tools and concepts available for income planning has played a key role in your heightened success. Two factors played essential roles: acquiring greater appreciation for the importance of risk mitigation when working with retirees; and the realization that you can work with annuities your way, in a manner that perfectly aligns with your culture, business model, philosophy and regulatory construct.

In March of 2023, 13 months after publication of my Fisher article, you sent me a lovely email thanking me for writing it, because, you said, “it served as the first step in opening my eyes to the importance of including lifetime, guaranteed income in a constrained investor’s retirement income investing strategy.” I wrote back to you indicating how pleased I was that my article helped facilitate that awakening.

Your essential three steps

Over the previous three years, never once, when speaking with retiree-age prospects or clients, did you fail to address the issue of the constrained investor. In fact, when you are working with clients whose central need is monthly income, your first three actions are, (1) determining the amount of income needed to fund a minimally acceptable lifestyle; (2) applying that income number to the income-to-assets ratio; and (3) showing your clients into which of the three categories of retiree investors they fit: overfunded, underfunded, or constrained.

Growth and transformation

It’s October 2025. As you begin the fourth quarter of the year, you are pleased – beyond pleased – with the way your practice has advanced in just a short time. Your personal transition to becoming a retirement-income distribution planner, which commenced in the fall of 2022, has transformed your practice:

- You have added a phenomenal $72 million in new client assets.

- Over the past 43 months, not a single client has been lost to a competing advisor.

- You win 100% wallet share from 100% of the retiree age prospects you meet with.

Inspiration to another RIA

At lunch with your old RIA friend, Ken, a man you have not seen in several years, you speak excitedly about the success you have enjoyed over the past three-plus years. As Ken listens, you tell him about the fantastic growth in AUM, the terrific client satisfaction the firm is generating, the improved new client acquisition, the referrals you routinely gather, your skyrocketing personal income, and even your website, about which you beam with pride. The contrast between what Ken is hearing from you, versus a silent voice in his head telling him about his own business, creates a conflicted emotional response.

Ken:

What were the major factors that launched you into this incredible success?

You reply:

Two things, Ken. First, understanding the power of constrained investor planning and the value it brings to my clients. Second, the reversal of my thinking about annuities, which I now use routinely to manage threats to my clients’ incomes.

When I made those two issues the central focus of what I speak about with retirees, I set in motion a burst of business growth and personal satisfaction that, frankly, I did not anticipate.

Look, Ken, I’d be happy to have you sit in during a client meeting so that you can hear how I speak about retirement income, my explanation of constrained investor, and how I talk about annuities. I have a couple coming in at 3:00 today who would not object to you joining. The same for a recent widow I will meet with on Thursday. Let me know if you’d like to sit in and listen.

Ken:

I don’t need to think about it, Ron. Your incredible success speaks for itself. It’s obvious to me that I need to make some meaningful changes in my business strategy.

While Ken pauses briefly, glances down, and then looks-up intensely at you and states, “I will be there,” the silent voice in his head utters, “I will be you.”

(End note: If you wish to introduce the benefits of annuities to your clients, this can help. I wrote an e-Booklet, “Timing Risk: An Overview for Consumers.” In language that is easy for any prospect or client to understand, it illustrates the problem and the solution. Download a free copy here.)

Wealth2k founder, David Macchia, MBA, RMA, CBBP, is an author, public speaker, and entrepreneur whose work involves improving the processes used in retirement income planning, especially in the context of Constrained Investors. He is the founder of Wealth2k Inc, and the developer of the widely used retirement income solution, The Income for Life Model. David recently introduced Women And Income, the first retirement income solution developed expressly for “Boomer” women investors. David writes frequently on the subjects of retirement income planning and macroeconomics. He is the author of the consumer finance books, Lucky Retiree, and the recently published, Constrained Investor. Constrained Investor® is a registered trademark of David Macchia.