By: David Macchia

Advisor Perspectives | December 14, 2021

Advisor Perspectives | December 14, 2021

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

If you follow the retirement income field, you are familiar with David Blanchett, head of retirement research at PGIM DC Solutions. I first became aware of Blanchett’s work when he was with Morningstar’s investment management group. I’ve listened to him speak at conferences and have read some of his research publications. An adjunct faculty member at the American College, Blanchett is a thought leader and central figure in the retirement income industry.

Recently, Blanchett ignited a controversy when he asserted at the InvestmentNews Retirement Income Summit that advisors breach their fiduciary duty when they fail to recommend guaranteed income products (annuities).

But Blanchett’s view should not be controversial.

I applaud his courage and perspective on this issue, which reflects my own.

Ten years ago, I made a presentation at the annual meeting of the Financial Planning Association. A portion of my talk focused on this same annuity question relative to advisors meeting fiduciary responsibility when it comes to retirement income planning. In the years since, this aspect of fiduciary duty has not advanced much.

In a recent article, I raised the issue again, asserting that duty is breached when advisors fail to recommend guaranteed income to a class of clients I call “constrained investors.” My article elicited a few comments from readers who implied that I was engaging in a disguised effort to market an annuity sales system. More than being untrue, these comments overlooked the substance of my arguments.

What is it about annuities that ignites heated emotions among some advisors? I think I know. The annuity industry has faced highly publicized market conduct problems. Some annuity contracts feature ridiculously expensive fee structures and/or limited liquidity provisions. I do not defend such annuity contracts. Over a number of years, in fact, I’m on record criticizing both poor sales practices as well as high-cost annuity contracts. However, I also strongly advocate for lifetime income annuities that are insurance against outliving one’s savings.

It’s strange that some advisors reflexively reject recommending income insurance but would never leave their homes uninsured against fire, or risk the financial liability associated with driving an uninsured car. Is the risk of losing one’s income any less catastrophic? This is why I continue to push hard on advisors to focus on determining if their clients fit the definition of constrained investors. To help make that distinction easier for you to determine, below I offer a framework that defines and categorizes three segments of retiree investors, including constrained investors.

Differentiate yourself in a lucrative market

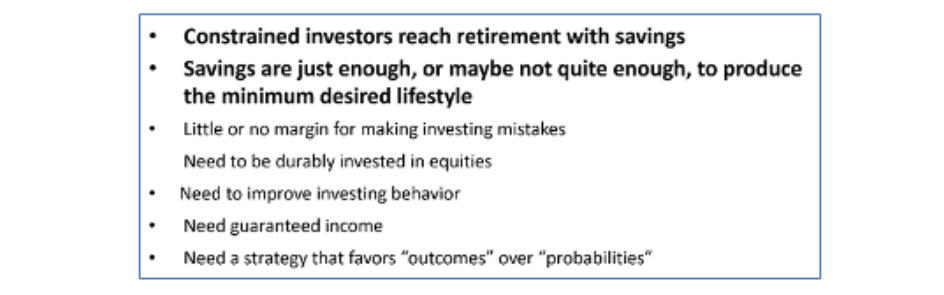

Constrained investors are a lucrative market. They frequently have substantial amounts of savings. They deserve your attention. But here’s the key. Although in absolute terms the amount of money constrained investors control is often substantial, it is not high in comparison to the income needed to fund their minimally desired lifestyles. To protect their long-range income generation capacity, therefore, constrained investors require protection against risks including timing, inflation, longevity, and confinement risks.

The income-to-assets ratio

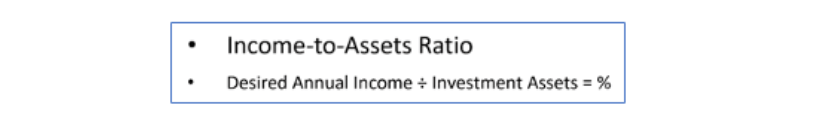

Here’s a “rule-of-thumb” framework that is simple but valuable in guiding you to understand who among your retiree clients is constrained. Determine the client’s income-to-assets ratio. To do so, divide the minimum lifestyle annual income objective by the amount of investable assets.

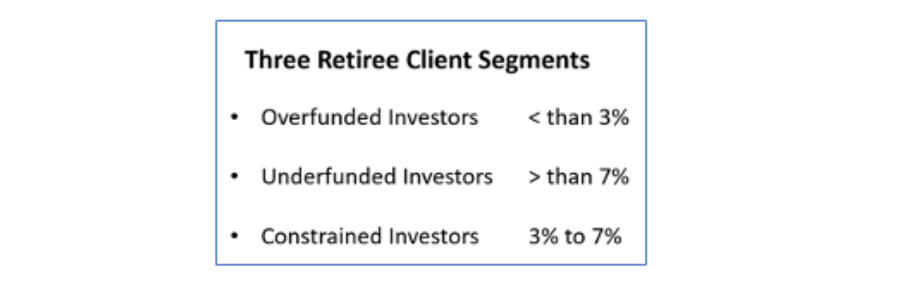

Once you have calculated the resulting percentage, map it to the three-category client segmentation matrix below to determine if your retiree client is overfunded, underfunded, or constrained.

Overfunded clients are unlikely to need an annuity. They are the fortunate individuals who have a surplus of liquid assets relative to their income goal. On the other end of the spectrum, underfunded clients are not the advisor’s best prospect. They tend to have low balances and will rely primarily on Social Security to provide their retirement income. In the middle are millions of desirable prospects – the constrained investors.

Consider a client with $4,000,000 in investable assets who expresses a minimum income objective of $200,000 per year. This client’s income-to-assets ratio is 5%. This client is a constrained investor. Yet, who wouldn’t want to work with a client who has $4,000,000 to invest? In practice, do constrained investors control significant amounts of investment assets? Typically, they have. In fact, I’ve seen numerous examples where these clients have $10 million or more. Expect the average client, however, to have investable assets of about $1.1 million.

In advancing these income planning concepts, I’m hoping to help advisors gain a better understanding of the responsibilities that emerge when advising retirees who are constrained. When you consider asset prices at today’s elevated levels – by some measures never more richly priced – timing (sequence-of-returns) risk is a scary matter that demands the advisor’s attention. With the control of more investment assets transitioning to women, it’s prudent to be mindful of the devastating financial outcomes that clients may suffer if longevity risk is not managed.

I agree with Blanchett’s view that failing to recommend guaranteed income can be a breach of fiduciary duty. Importantly, however, this is not true for all clients. That is why having a solid understanding of the constrained investor context will help you provide the best advice to retirees facing the challenge of creating inflation-adjusted income that lasts a lifetime.

At retirement, constrained investors benefit from the advisor’s expert guidance even more than other types of clients.

David Macchia is an author, retirement income industry entrepreneur and founder of Wealth2k, Inc. He is the developer of the widely used The Income for Life Model® as well as the recently introduced Women And Income™, the first retirement income solution developed for women investors.

Reproduced with permission from Advisor Perspectives, Inc. All rights reserved.