By: David Macchia

Advisor Perspectives | February 09, 2022

Advisor Perspectives | February 09, 2022

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

Mr. Fisher, please accept my thanks for your appearance today in my imagination for the purposes of conducting this trial. And congratulations on building a large and successful RIA firm. Through your firm’s ubiquitous, multimodal advertising, and your frequent appearances on television, you’ve become a well-known public figure. This is truly noteworthy.

I have charged you with crimes against annuities. I will begin this proceeding by expressing my gratitude for your anti-annuity advertising campaign including its famous tagline, “I hate annuities and you should too!”

Mr. Fisher, I am going to try to make you less of an annuity hater. I certainly do not want to see you risk eternal damnation in light of your passionate declaration, “I would die and go to hell before I would sell an annuity.” That is a stiffer penalty than any annuity surrender charge. But I’ll take you at your word that you’d prefer to throw away your own life rather than ever see one of your clients acquire an annuity.

For the purposes of this article, Mr. Fisher, I am putting you on trial for your advertising which I judge to be truly disgusting and not aligned with the financial well-being of your clients. I charge you with the following offenses:

- Misleading the public in a manner that causes incomplete or inaccurate understanding of annuities;

- Issuing a blanket condemnation that misrepresents the features and benefits of many annuities; and

- Depriving at least some of your clients the continuing income they will need to meet their essential expenses in retirement.

Mr. Fisher, you do a great disservice to consumers when you stigmatize a trillion-dollar industry, trivialize the social and financial benefits of an inordinately valuable retirement vehicle, assert that “most” annuities have “nosebleed-level fees” and “tremendous tax problems,” and “are hard to get out of once you’re in them,” and, finally, that annuities “are extremely confusing with a contract that’s about that thick.” When you say “thick” to describe the heft of annuity contracts, I assume that you mean that annuity contracts are roughly three-inches thick. As you hold your hand up in your video, three inches looks like the distance between your thumb and forefinger. Based upon my intimate knowledge of annuity contracts, you have exaggerated by approximately 93% the “annuity thickness issue.” This is no small infraction, especially since you apply this and all your other criticisms to “most” annuities.

Merriam-Webster dictionary defines “most” as “to the greatest or highest degree.” Your advertising leaves no room for consumers to discern the implied tiny segment of the annuity product population that isn’t deserving of your condemnation.

Mr. Fisher, now that I’ve charged you with these offenses, it’s time to hear the verdict. I ask you to remain in the courtroom until the verdict is rendered and today’s proceeding is completed in its entirety. After the verdict, I will demonstrate why it is in your self- interest to shift your position on annuities to one of acceptance, even if that acceptance is under a limited set of conditions.

Mr. Fisher, I find you innocent of all charges.

To be clear, I believe your advertising is appalling and very likely doesn’t meet fiduciary standards, but rather than lay blame at your feet, I am placing most of the onus on the annuity industry that by implication you so unfairly castigate. I assign blame to the annuity industry because it is at least indirectly responsible for your annuity perspective.

Allow me to explain.

For decades, Mr. Fisher, I’ve been frustrated by the regrettable reality that the annuity industry has never successfully communicated the value of its own products. It is a failing of gigantic proportions. It is also a failing that has personally benefited me by providing the opportunity for a successful 20-year career in marketing consulting.

I have been blessed with a gift. I can conjure the words and assemble them in an order that serves to de-complicate complex products and concepts. Until 2007, I helped several large insurers successfully launch their new annuity products.

Mr. Fisher, to ensure that annuity purchasers acquired an accurate understanding of annuity products’ provisions and benefits, I led a team that created multimedia educational presentations that were introduced at launch with the annuities. Your statement that annuities, “don’t do what the customer thinks they do” is unambiguously false, based upon my professional experience. The annuities I supported with needs-based communications tools were some of the most popular in the annuity industry. Buyers understood the annuities in question. Your assertion that they didn’t contradicts my work. But I forgive you. I forgive you because my agenda today is to accomplish a greater good.

I am not going to attempt to change how you feel about the “product.” Rather, I’m going to try to change how you think about the “client.” If I succeed, your view of annuities will necessarily change. My object is to be so persuasive that you will embrace annuities to such an extent that you will be comfortable in making the statement, “I would rather die and go to hell than fail to provide an annuity to a constrained investor.” Further, I hope to persuade you that failing to provide an annuity to a constrained investor is often a breach of your fiduciary duty.

But first, I acknowledge that there have been times when criticisms of annuities have been justified. Some annuity contracts incorporated complex provisions and had withdrawal penalties that went on for prolonged periods of time, or imposed strict limitations on liquidity, or had a very high-cost structure, or even incorporated all of these inferior dimensions. I have referred to this as the “bad apple” type of annuity. Fortunately, they have been mostly thrust out of existence. The truth is it’s easy to find annuities with consumer-friendly features.

In past years, several high-profile regulatory actions, as well as class-action litigation, served to damage the reputation of the annuity industry. Those developments related to market conduct issues, primarily the solicitation of seniors. But those problems involved only a tiny percentage of insurance companies and an even smaller share of the insurance-agent population. Happily, the insurance company offenders cleaned-up their poor marketing practices. Do annuities with relatively high commissions still exist? Not to the extent as in the past, but some do. What you will find among the many positive changes in the annuity industry is the availability of a spectrum of low-load or no-load annuities.

Mr. Fisher, certain investment advisors have been the most vociferous critics of annuities. Their views are often compromised by a competing financial agenda. From many years of personal experience in annuity wholesale distribution, I know that some investment advisors view annuities as competition for an investor’s savings. Mr. Fisher, I’ve personally met more than a few investment advisors who steadfastly declined to embrace annuities for all clients and in all circumstances out of their refusal to commit “annuicide.” Those advisors were not putting their clients’ interests’ first. Their behavior was unconscionable and a breach of fiduciary duty.

In 2007, I left the annuity business to devote my efforts exclusively to the business of retirement income planning. Over the past 15 years, I’ve helped start a not-for-profit think tank (The Retirement Income Industry Association, later acquired by Investments & Wealth Institute), served on its board of directors for eight years, earned the Retirement Management Advisor professional designation, worked closely with many of the leading academics whose research focuses on retirement income, implemented enterprise retirement income solutions at banks and broker-dealers, developed commercially successful retirement income offerings, spoken at dozens of retirement income conferences, written a consumer finance book (Lucky Retiree) on retirement income planning, and helped thousands of financial advisors become better income planners.

But for all that I have learned about retirement income, in terms of importance, there’s one piece of knowledge that stands above everything else: Clients with the same amount of investment assets may need dramatically different income-generation strategies.

Properly serving the constrained investor retiree

Mr. Fisher, I ask you to consider that there are three categories of retiree clients:

- Underfunded clients;

- Overfunded clients; and

- Constrained clients.

Underfunded clients typically have small investment account balances. For retirement income they will rely primarily on Social Security. Underfunded clients do not fit the investor profile your firm targets.

On the opposite end of the spectrum are overfunded clients. I imagine that a segment of your clients are overfunded. Overfunded means that client’s investment assets are more than sufficient to generate their targeted annual retirement income. Overfunded clients may have little or no reliance upon their investments to produce income.

Mr. Fisher, I’m going to assume that a large segment of your clients – perhaps a majority of them – are constrained investors. This is particularly important.

Let me define “constrained investor.” These are the clients who reach retirement with savings that isn’t high compared to the level of income they wish it to generate. This does not mean that constrained investors have low balances. On the contrary, they may have a great deal of investable assets. I’ve seen cases of constrained investors with $10 million or more.

The factors that categorize a retiree investor as “constrained” are twofold:

- Despite other lifetime income sources including Social Security, there is absolute reliance upon investments to produce income at a level sufficient to meet their minimum lifestyle objectives, and,

- When dividing the targeted amount of annual income by the total amount of investment assets, the result is greater than 3%. This percentage result I call the investor’s “income-to-assets ratio.”

For example, Mr. Fisher, imagine a 65-year-old female retiree, we’ll call Susan. Susan is a widow who has accumulated investment assets totaling $1.5 million. Susan needs to generate an annual income of $7,500 per month, or, $90,000 annually. Is Susan a constrained investor? To answer the question, divide her targeted annual income by the amount of her investment assets to calculate her income-to-assets ratio.

$90,000 ÷ $1,500,000 = 6%. (6% is > 3.0%). With an income-to-assets ratio of 6%, Susan is indeed a constrained investor.

Mr. Fisher, considering that Susan’s $1,500,000 is a full 3X your minimum client investment of $500,000, I imagine that you would consider Susan to be a very desirable client to acquire. But how would you deploy Susan’s money to create her needed monthly income? There’s little mention of the subject of retirement income at your website.

Now, while I can’t be certain, I think I know. You may recommend a withdrawal strategy. In a moment, I will share an example that will help you understand why recommending a withdrawal strategy is typically a reckless suggestion for a constrained investor client like Susan.

Once they’ve begun income distribution, constrained investors have little or no margin for error. They understand this because they recognize the reliance they have placed upon their savings. Any number of risk factors can derail the constrained investor’s financial security in retirement. Therefore risk mitigation must be the advisors’ first and foremost responsibility when working with constrained investor retirees.

Emotionally-based decision making is a huge risk for constrained investors. Gripped by fear in the face of plunging markets or periods volatility, constrained investors often sell out. The result of course, assuming they cannot fight against the urge to sell, is financially tragic: a permanent reduction of their retirement income. In the worst cases, a complete loss of their retirement income, eventually leading to portfolio ruin.

Mr. Fisher, keep this in mind: an individual’s standard-of-living in retirement is a function of income, not of wealth. I wish I had originated that sentence. I heard it emerge from the mouth of Nobel Laureate, Robert C. Merton. You see, Mr. Fisher, in retirement it’s all about income. In part, this is because the income-producing capacity of money changes all the time.

In 2000, Mr. Fisher, a client with $500,000, let’s call him Paul, could have purchased CDs paying 6.91%, generating a gross monthly income of $2,878.

By 2014, interest rates had plunged to 0.28%, driving Paul’s monthly income all the way down to $116.

Today, the interest rate is barely visible. At 0.09%, Paul’s monthly income is now a tiny $38. Here’s the point, Mr. Fisher. Throughout this period, Paul’s wealth never changed. But its capacity to generate income declined to virtually nothing.

I bet that you are going to tell me that Paul did not remain invested in CDs. And that he moved into equities in pursuit of better returns. And that it is has worked out for Paul. I agree with you. It has. But as I’ve written, we have lived through more than a decade when asset prices have been propped up by growth in credit. The Fed is signaling its concerns over inflation, ending its program of quantitative easing (QE), and perhaps reversing its money expansion program in favor of a shift to quantitative tightening. That was before Jeremy Grantham predicted $35 trillion in market losses as a result of an upcoming busting of the “superbubble.” I have been deeply worried about the financial carnage that will surely befall constrained investors who are nakedly exposed to timing risk. You should be equally concerned.

I’ve written several articles about the peril timing risk poses for retirees who are relying upon systematic withdrawal strategies to generate their retirement income. It’s an extreme threat that can permanently impair an investor’s capacity to generate income.

Why you should protect constrained investors against timing risk

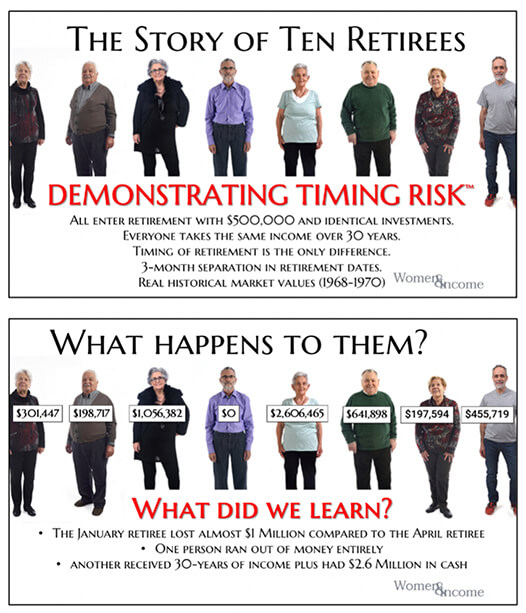

Mr. Fisher, imagine 10 financially identical people who have reached retirement age. Each has the same amount of savings ($500,000) as well as the exact same investment portfolio. Each will enter retirement and withdraw the same amount from their portfolios. What’s different? Only this: the timing of their retirements.

By separating each of their retirement dates by one calendar quarter, beginning on January 1, we see how destructive timing risk can be. Right away, you see why an investment advisor can’t ignore timing risk. The individual who retired first on January 1 ends up with about $1,000,000 more than the individual who retired second, on April 1. That’s right! Based upon only a 90-day difference in the dates of retirement, one unlucky soul loses out on $1,000,000 in income.

Among the 10 retirees, the disparity in results is sharp. One runs out of money entirely, while the luckiest among them receives income for 30 years, plus an ending balance of $2,600,000. Check-out how dramatic the financial results are for the other individuals. These images are from Wealth2k’s proprietary Women and Income Educational Seminar:

The portfolio has an asset allocation of 42.5% large-company stocks, 17.5% small-company stocks, and 40% intermediate-term government bonds and is rebalanced annually. The initial withdrawal amount was $1,686 per month, or for the first year $20,235 or 4.00% of beginning assets. The individual retiree withdrew the same dollar amount within each calendar year and adjusted annually for the prior calendar year’s inflation rate. The cost of funds in the portfolio is 100 basis points annually. Fund returns are from Ibbotson, Morningstar.

Why, I ask, would any investment advisor leave a constrained investor unprotected against timing risk?

Mr. Fisher, an advisor makes a grievous planning error when he or she recommends an income strategy that does not protect constrained investors against timing risk. Is it difficult for an investment advisor to mitigate timing risk? Not at all. It’s effortless. Remembering that the first 10 years of income distribution is the acute-risk period, all the advisor has to do is arrange the client’s assets in a manner that income over the first 10 years of retirement is generated from vehicles which are not subject to market risk

Mr. Fisher, no investment advisor can prudently ignore timing risk. Truth is, one of the easiest ways to protect clients is to include an annuity in the income strategy. Of course, advisors can easily access low-load or no-load annuities as well as options for trail-based compensation The critical issue is that, when it comes to constrained investors, neglecting timing risk is a professional failing of monumental proportions.

Women live longer

Mr. Fisher, I’d like to share another risk that is of great concern to me: longevity risk. For context, you have made statements about annuities that I vehemently disagree with. But then you made a statement so inaccurate and misleading that, were it not for the fact that I heard it with my own ears, I would not have believed you could have said what you said:

Anything you want to do with annuities, there’s a better way to do.

Mr. Fisher, in light of that statement, please describe a better way to provide a lifetime, guaranteed income to a client who wants a lifetime, guaranteed income.

I will give you the benefit of the doubt here. For the purposes of this article, I will assume that you did not know that only an annuity can guarantee a lifetime income.

I suggest that you read Kerry Pechter’s excellent book, Annuities for Dummies.

In a recent article I stated:

If it’s an overfunded client, an annuity is generally unnecessary. On the other hand, if the client is “constrained,” I don’t know how the advisor bypasses recommending an annuity. It’s an issue of morals as much as economics. If the client can’t tolerate the risk of not being able to meet his or her essential expenses, then there is no moral justification for you to deny your retiree client an annuity. If your client is a healthy female who is concerned about preserving her wealth, and who needs to rely upon savings to produce income, it is virtually malpractice to forego recommending an annuity in her income strategy.

This statement should not be controversial.

Mr. Fisher, I have made my case. It is in your firm’s self-interest to broaden its perspective on annuities. Specifically, I make these recommendations:

- Institute a training program that teaches employees how to recognize a constrained investor on the basis of the income-to-assets ratio.

- Explore the many available options for accessing low-load and no-load annuities.

- Mitigate timing risk for all of your constrained investor clients who are entering retirement or recently retired.

- Consider the use of cost-effective annuities, such as single-premium immediate annuities (SPIAs) and deferred-income annuities (DIAs), to help assure your clients that their incomes will be protected.

- Add a longevity (lifetime income) annuity to the portfolios of your constrained investor retirees, especially those who are female.

- Learn about the lifetime income annuities which have been created specifically for advisory accounts. These eliminate the deficiencies that you associate with annuities.

Mr. Fisher, most importantly, I implore you to awaken to a new perception of your retiree clients’ needs. Your firm and other advisory firms would be reckless and in many cases fail to meet their fiduciary responsibilities to constrained investor clients by failing to recommend an annuity to address longevity risk, and failing to mitigate timing risk.

Now that I have explained the constrained investor construct using the three-part client segmentation – overfunded, underfunded and constrained investors – are you more sensitive to their divergent needs? Do you have a better understanding of how annuities help them?

Mr. Fisher, nothing I have stated in this proceeding should be interpreted as an indication that all clients need annuities. They don’t.

But some clients do. And only annuities can deliver the certainty of continuing income. As I said before, It’s all about the income.

Thank you, Mr. Fisher, for appearing today.

I think I’m waking up.

Wealth2k® founder, David Macchia, is an entrepreneur, author, and public speaker whose work involves improving the processes used in retirement income planning. David is the developer of the widely used The Income for Life Model®, and the recently introduced, Women And Income®. David has authored many articles on the subjects of retirement income planning and financial communications. He also wrote the consumer finance book, Lucky Retiree: How to Create and Keep Your Retirement Income with The Income for Life Model®. Constrained Investor is a registered trademark of David Macchia.