By: David Macchia

Advisor Perspectives | April 01, 2022

Advisor Perspectives | April 01, 2022

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

In this article, I will explain how to structure an income strategy that best serves the needs of constrained investors. This is timely. Demographic, economic, cultural, and social forces argue for a new approach to retirement planning.

Few decisions are more crucial and consequential than a financial advisor’s recommendation to a retiree concerning how to generate income from savings. Given the importance of income to a retiree, Income – distribution planning has always been a high – stakes endeavor. Income planning mistakes and misjudgments are easily camouflaged by appreciating asset prices. The 14-year bull market has obscured a great many of those errors. But with positive performance of equity markets more doubtful, and with a shift away from the monetary policy that has kept asset prices climbing, the significance of advisors’ recommendations for retirement – income investing has grown.

When I entered the retirement income business in 2004, the talk among industry participants, led by the non-profit Retirement Income Industry Association, focused on the importance of “a view across the silos.” Because the vast majority of retirees benefit from an investing strategy that blends the best attributes of risk and protection, 2004 signified the onset of the acceptance that the development of next-generation retirement income solutions could not emerge from a single business silo. This realization led a half-dozen large, multi-line companies, all household names, to launch well-funded retirement income initiatives. Each sought to bring their company’s diverse business silos into close cooperation. The objective of those efforts was innovation in the form of asset-consolidating retirement income solutions for the “boomer” generation.

That grand retirement income ambition did not work.

It was not for lack of funding or an absence of CEO-level support. It was something much more basic and human: People from competing business silos would not cooperate.

With this history in mind, let us be reminded that no singular approach to generating retirement income has reached the status of a universally employed model. No “standard-operating-procedure” for income generation has materialized. Insurance advisors tend to favor all-guaranteed “safety first” solutions. Investment advisors favor market-returns-based income strategies. Each has arguments in favor of their preferred approach. Like the business silos in those large companies, vis-à-vis retirement income, advisors, apart from a small but growing segments of dedicated income distribution planners, are operating in their own silos. In fact, due to the distinct regulatory frameworks under which advisors are authorized to conduct business, it may well be impossible for an industry standard to ever emerge.

Michelle Richter is principal of Fiduciary Insurance Services, LLC, and executive director of the Institutional Retirement Income Council, LLC, A deep-thinker with a razor-sharp intellect, and high-level management experience in both asset management and insurance, Richter has developed a clever construct to differentiate between the sellers of advice, the “verb sellers,” versus the sellers of products, the “noun sellers.”

Richter believes that giving good retirement income advice requires a financial professional to understand both the asset and the liability sides of the consumer balance sheet. She views the need for financial professionals to address not merely a single silo, but rather the intersection of asset and liability management – including appropriate uses of insurance – is what drives the consumer’s experience of aging. I heartily agree.

Richter sees the need for a corollary to the 40 Act that would govern insurance advisement. She says, “Until the value of liability management is systematically recognized, insurance products will continue to be viewed by asset managers as expensive, because it is definitionally the case that to provide liability management within a product is inherently more expensive than is to not provide liability management within a product.” Richter sees wealth and asset management as distinct fields. She believes that wealth inures to, and then remains in the hands of, those who manage the intersection between assets and liabilities, and as such, she views wealth manager as synonymous with financial planners – those who can advise upon this intersection.

While we wait for possible changes in regulatory frameworks, we have millions of retirees who need income planning guidance. And for most of them, risk management and capital growth are equally essential.

The income plan for constrained investors

Imagine that you could design the “perfect” retirement income investing strategy for a constrained investor. To determine if someone is a constrained investor, calculate the ratio of their minimum annual living expenses (net of Social Security and pension income) to the value of their investment assets. If that ratio is greater than 3%, they are a constrained investor.

What features and qualities would you want it to provide? Here are my characteristics of the “perfect” income plan for constrained investors. See if you agree.

- Transparent and understandable to an extent that any prospect or client can grasp how it works;

- Mitigates key risks, including timing, inflation, and longevity risks;

- Creates investment discipline that keeps the client fully invested every day, irrespective of how volatile asset prices may become, or how deeply markets may plunge;

- Provides the confidence and peace-of-mind that accompanies a safe monthly paycheck throughout retirement;

- Provides income sufficient to fund, at the very least, the client’s definition of a minimally acceptable lifestyle, even in a scenario where capital markets never generate positive returns;

- Provides a “floor” of guaranteed monthly income that your client cannot outlive;

- Includes an aggressively invested, fully-liquid, 25-year-hold capital appreciation account to deliver additional old-age income, or, to serve as a legacy for family members or charities, or, to offset costs associated with long-term care;

- Generates lifetime, inflation-adjusted income based upon the attainment of reasonable rate-of-return objectives; and

- Is functionally immune from replacement by another advisor.

The seven-segment hybrid strategy mitigates risks, optimizes income security

The first order priority of the constrained investor’s income strategy is risk mitigation. Therefore, the systematic withdrawal plan (SWP) is off the table. In previous articles, I’ve explained why a SWP is a reckless recommendation for constrained investors. A much better approach is the seven-segment hybrid strategy. It may be different than you are accustomed to, but investing the time to learn about the hybrid strategy will pay you back handsomely.

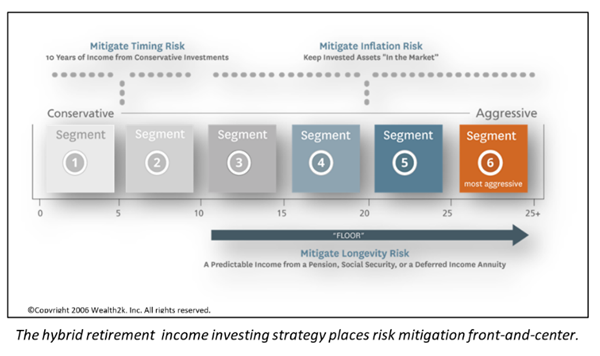

Addressing risks that can reduce or entirely consume the constrained investor’s retirement income is the income planner’s chief priority. How best to manage key risks? This is achieved by blending time-segmentation (“bucketing”) with “flooring,” via lifetime income from an annuity. This hybrid strategy provides the answer to what ails constrained investors.

The image to the right illustrates how a direct linkage is created between risks that require mitigation, the various segments, and the investments funding them. This linkage is the key to providing constrained investors must-have protection against timing, inflation, and longevity risks.

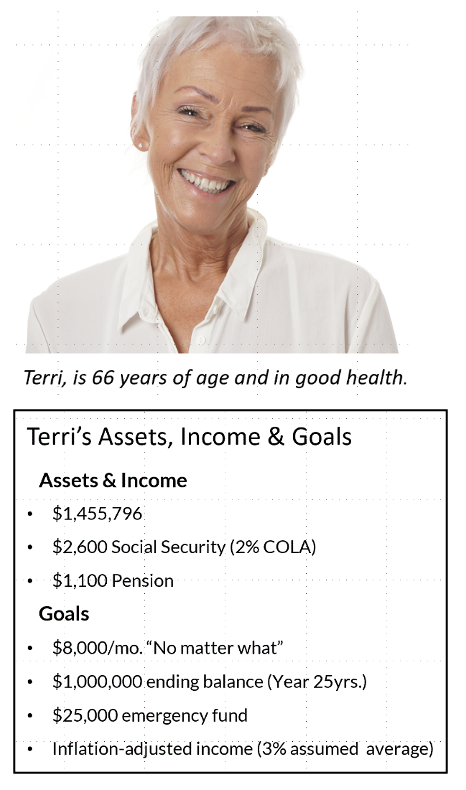

Let’s look at an example of a 66-year-old, recent retiree we will call Terri. With $1.45 million in retirement savings, it’s time to design an income-focused investing strategy for her.

Terri’s monthly Social Security income of $2,600, as well as her $1,100 per month pension, will help her meet expenses in retirement. However, to fund her minimally acceptable lifestyle, Terri needs a monthly income of $8,000. Further, she makes clear to her advisor, Mark, that the $8,000 monthly income must be absolutely certain, “So that I can sleep at night,” states Terri. With this stipulation understood, Terri tells Mark that she will be comfortable with having a significant share of her assets invested in equities. Terri understands that this is the pathway for keeping her overall monthly income on pace with inflation.

Using the income-to-assets ratio, Mark performs a quick calculation to determine that, based upon her 3.6% result, Terri is a constrained investor. He is not surprised, of course. Mark has learned that, due to their unconditional reliance on savings to produce required monthly income, constrained investors often express the desire for a threshold monthly income that is certain.

Terri expresses an additional goal. She would like to leave a legacy to her grandchildren. After discussing this with Mark, Terri decides that $1,000,000 is the ending balance accumulation that her strategy will seek to provide. Mark explains that the ending balance can be used for any purpose, including providing Terri additional old-age income. Mark suggests that $25,000 be kept alongside income plan in a liquid account that will be available for any cash need that may arise.

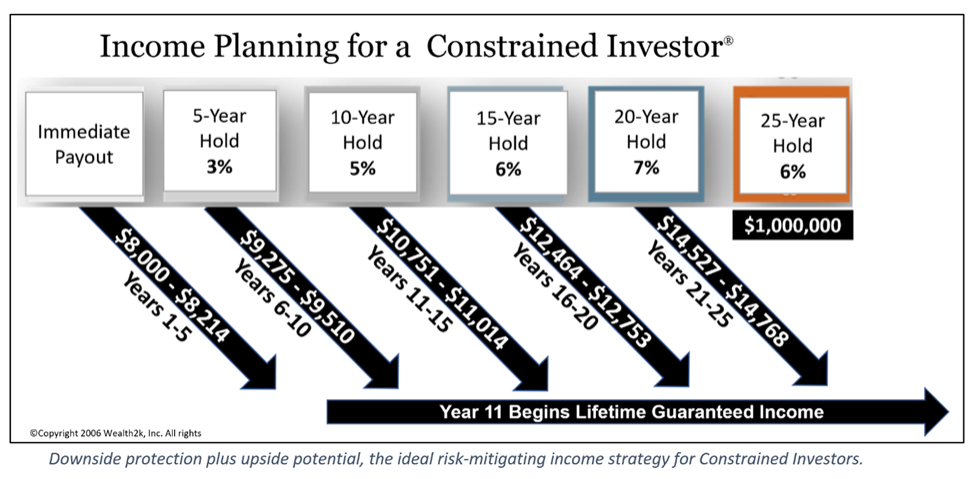

Mark’s 7sevensegment hybrid plan will have three major components:

1. Five, five-year segments to produce income over a 25-year period;

2. A sixth segment in the form of an aggressively invested, fully-liquid, 25-year-hold capital appreciation account. Its purpose is to provide additional old-age income, or, to serve as a legacy for Terri’s grandchildren, or, to offset costs associated with long-term care; and

3. A seventh segment, funded by an annuity that, beginning in year 11, will pay Terri $2,000/month for life.

Segment 1 is a cash-equivalent vehicle that liquidates itself over 60 months. It is also the most important segment in Terri’s strategy. Segment one’s benefits are as much psychological as economic. (Some advisors get caught up in the low yield of segment 1, feeling that it precludes higher accumulation. Do not fall into this trap. Read why here.) With the confidence that her paycheck is secure, the importance of which cannot be overestimated, Terri gains peace-of-mind and staying power. She is anchored to the strategy by segment 1.

While segment 1 is paying out, all the other segments are left to accumulate. When segment 1 is fully depleted, the money in segment 2, which has been accumulating for five years, is brought into a safe money orientation, exactly like segment 1. Segment 2 then provides Terri another five years of safe paychecks, but with a step-up. From the standpoint of income, we have covered the first 10 years of the retirement with no risk.

Because Terri’s income is secure over the first decade, the income from the “floor” annuity is not needed until year 11. More on this below,

Segments 3, 4, 5 and 6 are held for 10, 15, 20, and 25 years, respectively. Importantly, no matter how aggressively these segments may be invested, when it comes time to use them to produce income, we put the money into a safe orientation. Continuous safe paychecks represent a key advantage of the hybrid strategy. The certainty of monthly income is what will enable your clients to stay fully invested through even the worst days of stock market performance. It is easy to lose sight of how significant of an advantage this is. Living through a bull market of unprecedented duration will do that.

About Terri’s equity risk exposure in retirement: Mark explained that Terri’s money can and should be at risk. But he also said, “Terri, your income can never be at risk.” The importance of Mark’s comment aligns perfectly with one of my favorite quotes. It is from the economist and Nobel Laureate, Robert C. Merton: “In retirement, it’s your income, not your wealth that creates your standard-of-living.” Income is everything to a retiree. Speaking about retirement income, Merton also said, “You’re not going to want to take a pay cut.” I think of that statement every time I read about a “dynamic” withdrawal strategy.

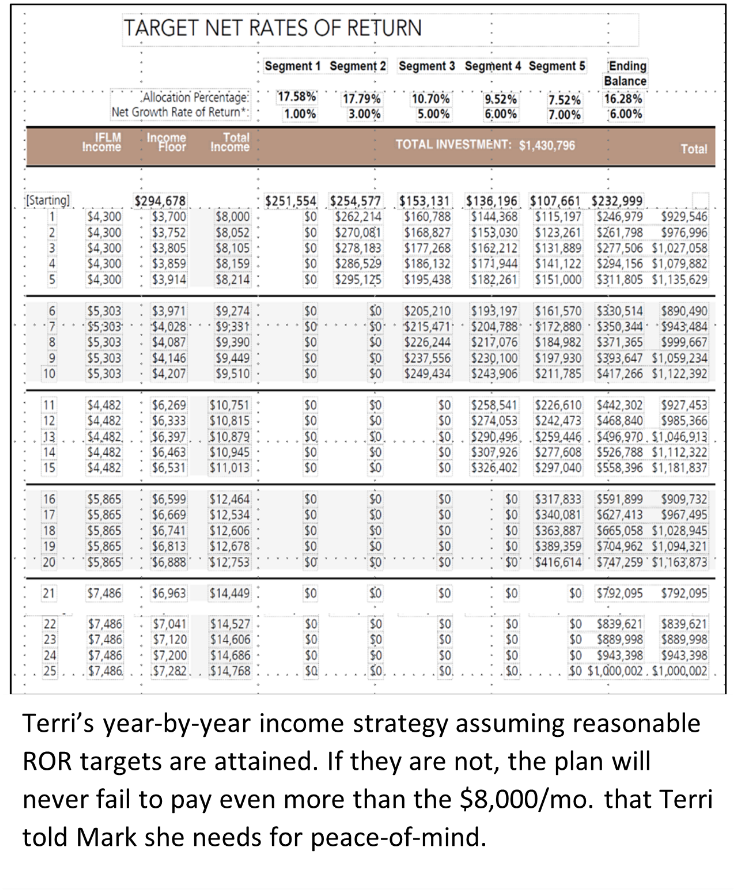

Terri and Mark discussed rate-of-return (ROR) objectives for the segments. Mark felt that the ROR targets agreed to were quite reasonable: 1%, 3%, 5%, 6%, 7%, and 6%. Note that the 6% ROR target in segment 6 is rather conservative considering the aggressive investment orientation, and the 25-year holding period. However, Terri did not want to reach too high in this segment. She felt that her ending balance objective would more easily be attained with the 6%, long-term growth target. Mark understands that there is a good chance that segment 6 will overperform.

If the ROR targets are realized, the five segments will produce 25 years of inflation-adjusted income. In addition, segment 6 will grow to $1,000,000.

Because two notable things will occur at that point, year 11 is an important juncture in Terri’s plan. This is when she accesses money from segment 3 to produce safe paychecks in years 11 thru 15. Due to its 40% to 50% allocation to equities, segment 3 may underperform over its 10-year holding period. To guard against the risk that underperformance causes Terri’s total income to fall below the threshold, the annuity income commences in year 11. This is an example of downside protection that offers the highest appeal to constrained investors. Once they see this aspect of the plan, it is all but impossible to sell against.

Assume that we hit our reasonable target rates-of-return. In years 11-15, Terri’s monthly income would increase from $10,751 to $11.013. These increases are attributable the assumed 2% COLA on her Social Security.

In year 16, Terri’s income has a big bump up, to $12, 464. The increase represents a pay raise equal to an annualized 3% inflation adjustment. The Social Security COLA also kick in, and monthly income by year 20 has grown to $12,753.

Once again, there is a pay increase for Terri. Beginning in year 21, Terri’s income is $14,449 increasing to $14,768 in year 25.

Year 26 and thereafter: Options

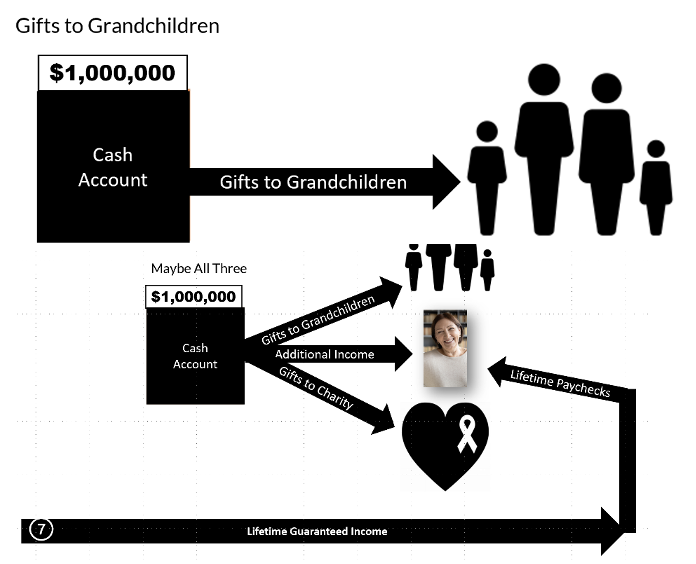

Assume that 25 years have passed. Terri has enjoyed a financially successful retirement. Her income plan has provided 25 years of inflation-adjusted income. Now what?

Firstly, similar to her Social Security and pension benefits, Terri’s annuity continues to pay her monthly income. Secondly, Terri has $1,000,000 that she can use for any purpose, including providing herself continuing income. Terri has other options. In addition to paying herself, she may decide to make gifts to her grandchildren or a charity.

Balance is good

One of the best attributes of the seven-segment hybrid strategy is its balancing of protection and risk. Because, as I said in the beginning, no standard approach to income generation has emerged, it is going to be important for advisors, and RIAs especially, to embrace strategies that incorporate risk-mitigation features.

In 2013, I wrote an article for Retirement Management Journal. Addressing different channels, I asserted that, “The RIA channel is arguably the least prepared for retirement income. As a result, RIAs are at the greatest risk of becoming competitive marginalized by marketplace dynamics.” I offered reasons for this belief including RIA’s traditional opposition to annuities. I also wrote this:

RIAs historical focus on maximizing investment returns is misaligned with retirees’ deeper concerns for downside protection and smooth, monthly income.

Take those words to heart. If we are indeed past the long bull market, then in the years ahead, advisors who do not plan income with a balanced strategy will lose clients and assets.

Annuities changed in dramatic fashion

Since I wrote the 2013 article, one of the most important innovations to have emerged is the transformation of annuities into risk-mitigation tools that harmonize perfectly with the RIA business model and regulatory framework. In 2013, annuities were asking RIAs to accommodate them. After years of that strategy not working, annuities have transformed; they changed to accommodate you.

Nothing is without context, including, of course, the advice I am asking you to take to heart. The “big context” today is transformational to a degree never seen. Women are the face and future of wealth. Keep these words close:

RIAs historical focus on maximizing investment returns is misaligned with retirees’ deeper concerns for downside protection and smooth, monthly income.”

Time to strike a balance!

Author’s note: I would be happy to share a copy of the income plan upon which this example is based. Just email “income plan” to david@wealth2k.com.

Wealth2k founder, David Macchia, MBA, RMA, CBBP, is an author, public speaker, and entrepreneur whose work involves improving the processes used in retirement income planning, especially in the context of Constrained Investors. He is the founder of Wealth2k Inc, and the developer of the widely used retirement income solution, The Income for Life Model. David recently introduced Women And Income, the first retirement income solution developed expressly for “Boomer” women investors. David writes frequently on the subjects of retirement income planning and macroeconomics. He is the author of the consumer finance books, Lucky Retiree, and the recently published, Constrained Investor. Constrained Investor® is a registered trademark of David Macchia.