By: David Macchia

Financial Advisor | February 11, 2022

Financial Advisor | February 11, 2022

In an earlier article, I asserted that investment advisors may quite regularly breach their fiduciary duty by failing to recommend an annuity when working with a certain type of client I call the constrained investor. In fairness, I cannot be too critical of advisors who until now have preferred to avoid annuities. The reason I can’t is that, historically, advisors had no convenient framework to work with that makes it easy to determine whom among their clients is or isn’t a constrained investor and, by extension, to determine which clients required the inclusion of an annuity.

In this article, I will define a framework. I will also expand on some of the risks that threaten constrained investors’ retirement security. These risks demand the advisor’s closest attention. And I will end this article with a call for all of us to rally around a new appreciation for how to best-serve the retirement security needs of a large and critically important segment of investors. This includes most women approaching retirement or recently retired. First, the risks.

Timing Risk: ‘The 90-Day Rule’

Sequence-of-returns risk is a phenomenon that most advisors are familiar with. Many attempts have been made to illustrate the potentially negative impact of sequence-of-returns. Among these are scenarios illustrating side-by-side comparisons of annual investment returns. One scenario illustrates actual results over a lengthy period of years, and the other illustrates what would happen if the sequence of annual returns were to be reversed. The two net results can be dramatically different. Of course, that’s the point. These types of illustrations of sequence-of-returns risk can be effective, but I do not favor them. Numbers intensive, they can be confusing to some clients. Let me offer you another approach, one that any prospect or client can easily understand.

The Story Of 10 Retirees

As you look your prospect or client in the eyes, ask him or her to imagine 10 financially identical people. The 10 people are identical in the sense that all have the same $500,000 in retirement savings, all 10 have identical investment portfolios, and when they retire, all will withdraw the same amount of monthly income. What’s different among these 10 financially identical people? Only this: Timing.

To conceptually demonstrate the destructive potential of timing risk, we will separate their dates of retirement by a calendar quarter (90-days) until all 10 have retired. Then, we’ll look at what happens to them over the following 30-years.

The first individual will retire on January 1, the second on April 1, the third on July 1. It will continue in this fashion until all 10 are retired. Next, we will pick n historical, 2-year period to sequence the 10 individuals’ retirements. The example will use actual market values for this period.

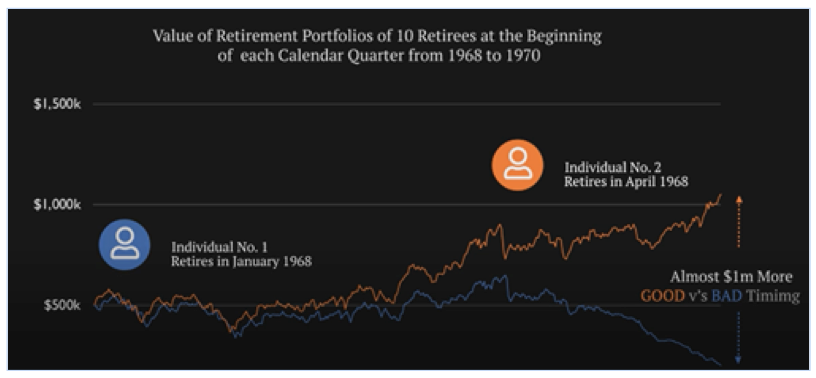

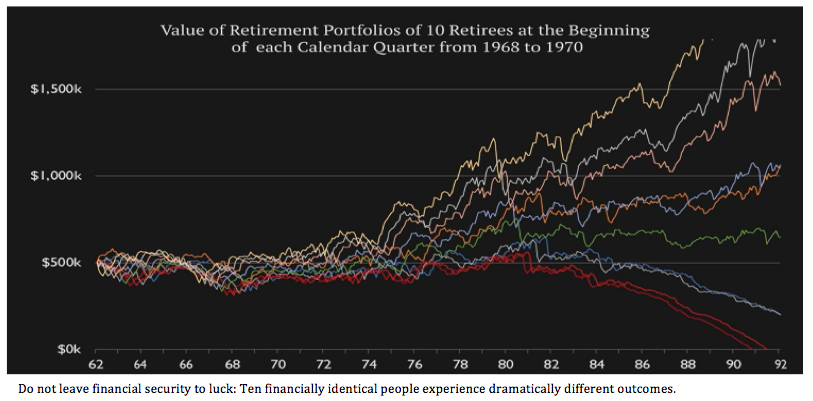

What do we learn? In short, we learn how utterly dangerous it is to leave a client’s retirement security to chance. Let’s focus on the first two people to retire. Call them Susan and Sheryl.

Sheryl, who retired second, ends up with almost $1,000,000 more retirement income than poor, unlucky Susan. If only Susan had waited until spring to retire—three months—her quality of life in retirement would have been enormously improved. But it’s even worse for the fifth retiree, Phil.

Phil suffered portfolio ruin. No income. No wealth. No luck.

But what a contrast between unlucky Phil and lucky Sally. Sally received inflation-adjusted income for 30 years plus she accumulated wealth of $2,600,000.

You may think this example is oversimplified. I ask you to trust me that it’s not. It’s powerful. I even authored a book about it, Lucky Retiree. If you use this example with prospects and clients, you will quickly see how effective it is. There is a data spreadsheet from which these results derive. I will be happy to share it with you. Just email support@wealth2k.com and ask for the Ten Retirees Spreadsheet.

Timing Risk And The Constrained Investor

When it comes to timing risk, it is vital that advisors protect constrained investors. But who exactly is a constrained investor? Let me share a simple framework that makes it easy to answer the question.

There are three segments of retiree investors:

• “Overfunded” investors

• “Underfunded” investors

• Constrained investors

Overfunded investors are a lucky minority of clients whose level investable assets are more than is required to meet their targeted annual retirement income. Overfunded investors are sought after clients.

Underfunded investors have low balances and will rely primarily upon Social Security to provide their retirement income. Underfunded investors are not your ideal prospects.

Constrained investors represent a large and lucrative market segment. They make up the majority of people who have consistently saved for retirement. Constrained investors may have investable assets of up to $10 million, or even more. Commonly, however, they will have typically accumulated between $1,000,000 and $2,500,000. They are desirable clients.

The Income-To-Assets Ratio

To determine if you are working with a constrained investor, use the income-to-assets ratio:

Minimally Desirable Annual Income ÷ Investable Assets = %

≥ 3% = Constrained Investor

A client, call her Paula, has investable assets of $1,500,000 and a target monthly income of $6,000 ($72,000 annually). Using the income-to-assets ratio, we find that Paula’s 4.8% ratio indicates that she is a constrained investor.

$72,000 ÷ $1,500,000 = 4.8%. ( 4.8% is > 3%)

Priority one for the advisor designing Paula’s investment strategy is protection. It has to be safety first because Paula must be protected against timing risk. This would be true in all investment “seasons.” But today, with equity prices turning downward, inflation surging, interest rates climbing, the Fed signaling monetary tightening, and economic uncertainty increasing, an advisor’s failure to protect against timing risk is, in Paula’s case, cruel and unusual punishment. Fortunately, timing risk is one of the easiest risks to mitigate. Just setup the investing strategy in a manner that safe investments (no equity exposure) are providing Paula’s monthly income during the first 10 years of her retirement. Annuities are not required to manage timing risk. They are, however, the easiest way to lock down stability and safe, monthly income over this period.

Paula’s Longevity Risk

When working with constrained investors like Paula, a risk that the advisors are bound by fiduciary duty to address is longevity risk. In a recent article, I called out Ken Fisher for this statement he made in a video:

“Anything you want to do with annuities, there’s a better way to do.”

I asked Mr. Fisher a question which remains unanswered:

If a client wants a lifetime guaranteed income, what vehicle provides a better way to provide a lifetime guaranteed income?

Paula is a healthy female 65 years of age, whose mother lived until age 95. This means that Paula’s longevity risk is significant. I cite the words of Nobel Laureate, Robert C. Merton:

In retirement it’s your income, not your wealth, that creates your standard-of-living.

Merton’s statement is brilliant in its simplicity, which cuts through a great deal of needless complexity. I like to say this: No retiree stops needing income. That includes a retiree like Paula, someone who, if she outlives her mom by only six years, will reach age 101.

There is but one income-producing vehicle that an advisor can count on to be paying his or her client at age 101. That, Mr. Fisher, is a lifetime income annuity.

Time For The Annuity Industry To Rally (In A Different Way)

I know of only a single trillion-dollar industry that has been unable to effectively communicate its own value. Why? A consuming, product-centric way of thinking. For decades, the annuity industry has, without success, sought to change the way RIAs think about the “product.” It will not work. What will work is an initiative that changes how investment advisors think about the “client.” That is what I am attempting to do as I write these words. If you are a fiduciary advisor reading these words, have I made progress? Does the three-part client segmentation construct make sense to you? Have I succeeded in demonstrating how the constrained investor’s retirement security can be jeopardized when key risks are left unmanaged?

I feel like I am doing God’s work here. Income planning for constrained investors must be different than what can be appropriately used with other investors. The stakes for constrained investors are simply too high. The potential financial impact of unmanaged risks, too adverse. Ask Phil if he enjoyed experiencing a retirement featuring “portfolio ruin.”

Time To Rally

I call upon the investment advisor community, chief executives of annuity providers, presidents of broker-dealers, top annuity wholesale distributors, leading annuity industry consultants, rank-and-file brokers, and insurance agents to come together in an initiative that results in the annuity industry rallying round the constrained investor planning construct. It is time to foster a new era of best serving retirees.

David Macchia is an author, public speaker and entrepreneur focused on improving the current state of retirement income planning. He is the founder of Wealth2k Inc, and the developer of the widely used retirement income solution, The Income for Life Model. Recently, Macchia developed Women And Income, the first retirement income solution developed to address the differentiated needs and preferences of female investors. He is the author of the consumer finance book, Lucky Retiree: How to Create and Keep Your Retirement Income with The Income for Life Model.