By: David Macchia

Advisor Perspectives | January 11, 2022

Advisor Perspectives | January 11, 2022

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

It was a sweetheart deal. Back in August 2019, the German government sold €824 million worth of AAA-rated 30-year bonds. Assuming that these bonds are held to their maturity in 2050, the investors who purchased them will get back €29 million less than they paid for them, or €795 million. I remember reading about this bond sale and thinking, “That’s the craziest thing I’ve ever heard. How fearful of the future must one be to do this?”

Locking-in a 30-year loss doesn’t appear to be a particularly savvy investment decision. I’m old enough to remember the concept of time value of money! Yet, bond purchasers assumed that in the future they would be able to flip these bonds for a profit when interest rates dropped even further into negative territory. That investment strategy hadn’t occurred to me.

It turns out that Germany is still making out well selling bonds that offer negative returns. In 2021, Germany borrowed $544 billion at an interest rate averaging -0.56%. In spite of the negative yield, according to US News & World Report, the bond auctions were oversubscribed 1.7 times. Are investors anticipating that interest rates will plummet even further?

Negative interest rates have become a feature of numerous national economies. These include the 19 euro-area countries where the short-term interest rate stands at -0.57%, as well Israel and Japan. Why haven’t negative interest rates hit our shores? The answer is found in the Fed’s now massive use of the reverse repurchase agreements, a mechanism for it to adjust the level of bank reserves, impact asset prices, and more.

What’s a “reverse repo?”

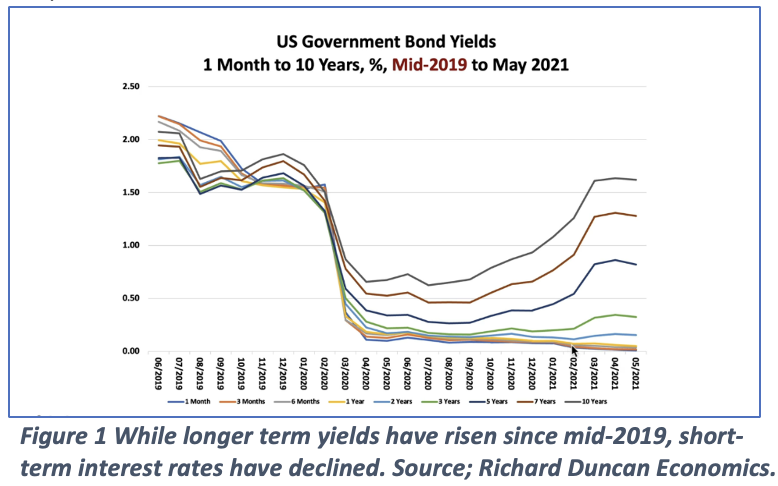

By way of background, the Fed’s injection of liquidity through quantitative easing (QE) has pushed down interest rates at the short end of the yield curve.

As of the date I’m writing this, the one-month Treasury yield is 3 basis points. That’s a spectacular decline compared to the 1.58% yield back in February 2020. Although the Fed has signaled its intent to wrap-up QE early next year, when you consider the breathtaking amount of QE that the Fed has injected into the economy since the beginning of the pandemic, one may have assumed that interest rates would have already moved to a level below 0%.

But they haven’t.

A danger to the money market industry

It’s easy to imagine the potential for significant harm to the money market industry if short-term interest rates were to go negative, with follow-on contagion to the larger financial markets. Recall that a money market fund is a mutual fund. Money market funds invest in cash, cash equivalents and short-term, high-quality debt instruments such as short-term U.S. government debt, CDs, bankers acceptances, commercial paper and repurchase agreements for short-term government securities. Interest rates falling into negative territory would severely test the ability of money market funds to remain stable and profitable. Such a scenario would drain assets away from the money market funds, perhaps to a dramatic extent. This outcome would suppress demand for government and agency debt. It would also remove a vital component of corporations’ and banks’ overnight funding needs through their traditional use of commercial paper and bankers’ acceptances. A destabilization of the money market funds could lead to a loss of vital overnight funding that would rattle the entire financial system. There’s a lot at stake in keeping positive-return investment options available to money market funds.

Banks do not face the same challenge as money market funds. This is because the Fed pays interest on bank reserves. Currently, the Fed is paying 15 basis points on bank reserves. Think about the meaning of this. Even though it is a tiny rate of interest, paying 15 basis points on bank reserves guarantees that banks will not have to invest in any assets that pay less than 15 basis points. This means that no matter how large bank reserves may become, they will not drive interest rates below 0%.

A $4 trillion dilemma

Ensuring that bank reserves won’t drive interest rates into negative territory is great for the banks. But what about money market funds? Unlike the banks, money market funds do not maintain reserve accounts at the Fed. Yet, they play a significant role in the financial system. According to the Investment Company Institute, money market fund assets totaled $4.67 trillion as of December 22, 2021.

The mass of cash – excess liquidity – being held in the money market funds creates the risk that interest rates will plunge below 0%. To manage that risk, the Fed employs a process using reverse repurchase agreements. What is a reverse repurchase agreement? A repurchase agreement is a contract by which, in exchange for collateral, the Fed extends credit to a counterparty for a specified period of time, generally overnight. The process of using repurchase agreements pumps liquidity into the financial markets. At the end of the contract term, the counterparty repays the Fed and gets back its collateral. The repayment of the loan takes liquidity out of the financial markets. As I said, repurchase agreements are usually overnight transactions, but they can often be rolled over for extended periods of time.

Reverse the process and you have a reverse repurchase agreement. With a reverse repurchase agreement, the Fed borrows from the counterparty and provides collateral to the counterparty. This process removes liquidity from the financial system. Currently, the Fed is paying 5 basis points on reverse repurchase agreements. Why is this payment of a nominal rate of interest so important? It provides money market funds a place to invest that does not have a negative yield.

Owing to the Fed’s creativity, or perhaps generosity, both banks and money market funds are provided a place to invest by the Fed that ensures neither will be forced to invest at rates less than 15 and 5 basis points, respectively. Reverse repurchase agreements provide the Fed the mechanism to prevent massive, QE-driven excess liquidity from driving interest rates into negative territory.

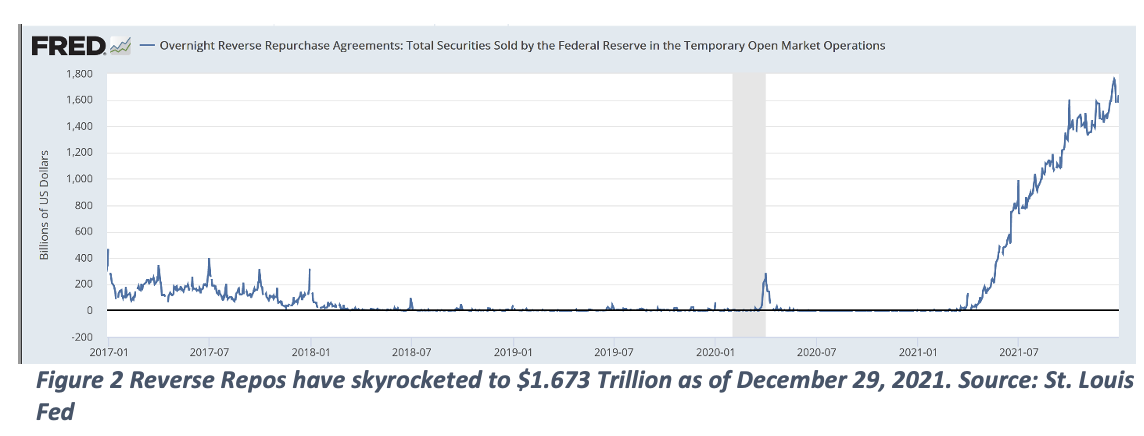

In March 2021, the Fed increased the counterparty limit for reverse repurchase agreements from $30 to $80 billion. The following month, the Fed broadened the scope of institutions that can engage with it for reverse repurchase agreements. Now, in addition to banks and government-sponsored enterprises like Freddie and Fannie, investment managers like BlackRock Advisors, LLC,, Vanguard Group, Charles Schwab and Dimensional Fund Advisors can also play. Does this imply that the Fed views reverse repurchase agreements as a crucial tool?

I’m guessing “yes,” truly crucial. On January 15, 2021, the Fed had exactly zero dollars in reverse repurchase agreements. Today it has more than $1.6 trillion.

QE, stock prices and reverse repurchase agreements

In December, I wrote an article for Advisor Perspectives entitled When Capitalism Died, And How Creditism Replaced It. The article explained how the Fed’s use of QE and the creation of massive amounts of new credit has propelled stocks and other asset prices higher. By providing a mechanism to remove liquidity from the financial system through reverse repurchase agreements, the Fed has prevented asset prices from moving even higher than today’s stratospheric heights.

By expanding its use of reverse repurchase agreements, the Fed has shown us that its creativity is limitless. Hopefully, the future will reveal that its wisdom has matched its creativity.

Author’s note: My thanks to macro economist Richard Duncan for allowing me to use several charts from his video newsletter Macro Watch. Duncan is graciously offering a 50% discount to any reader who wishes to become a Macro Watch subscriber. I highly recommend this newsletter as it is full of original information and valuable insights. If interested in a subscription, visit here and enter the discount code: Life.

David Macchia is an author, retirement income industry entrepreneur and founder of Wealth2k, Inc. He is the developer of the widely used The Income for Life Model® as well as the recently introduced Women And Income™, the first retirement income solution developed for women investors.

Reproduced with permission from Advisor Perspectives, Inc. All rights reserved.